Blog

How AI is Transforming Automated Trading?

Financial markets never sleep and neither does technology. In recent years, AI trading bots and advanced AI trading software have changed how traders approach the market.

What used to be a world of manual chart analysis and emotional decision-making is now driven by AI stock trading apps, powerful AI trading platforms, and even AI crypto trading bots that work 24/7.

At QuantSutra, we’ve seen firsthand how AI for stock trading is reshaping strategies for both retail and institutional investors.

The big question is how exactly is AI transforming automated trading, and what does it mean for traders in the long run? Let’s discuss.

From Manual to Machine: A Quick Shift?

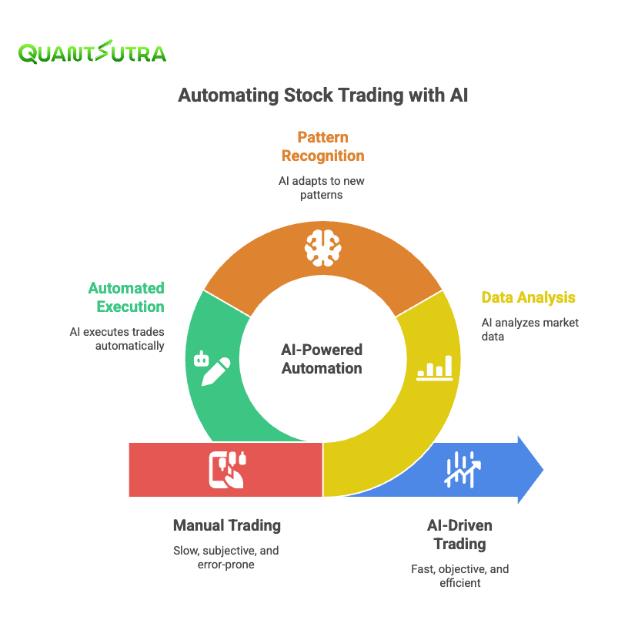

Not too long ago, most trades were executed manually. Traders relied on technical indicators, personal experience, and sometimes gut instinct. The rise of algo trading opened the door to automation.

Now, with AI for trading stocks, that automation has become far smarter.

Instead of relying only on pre-set rules, today’s AI trading applications learn from data, adapt to new patterns, and make decisions faster than any human could.

- AI in trading means using algorithms and machine learning to analyze market data and automatically execute trades with minimal human intervention.

Platforms like QuantSutra empower retail traders with institutional-grade AI tools, bridging the gap between human insight and machine efficiency.

What is an AI Trading Bot?

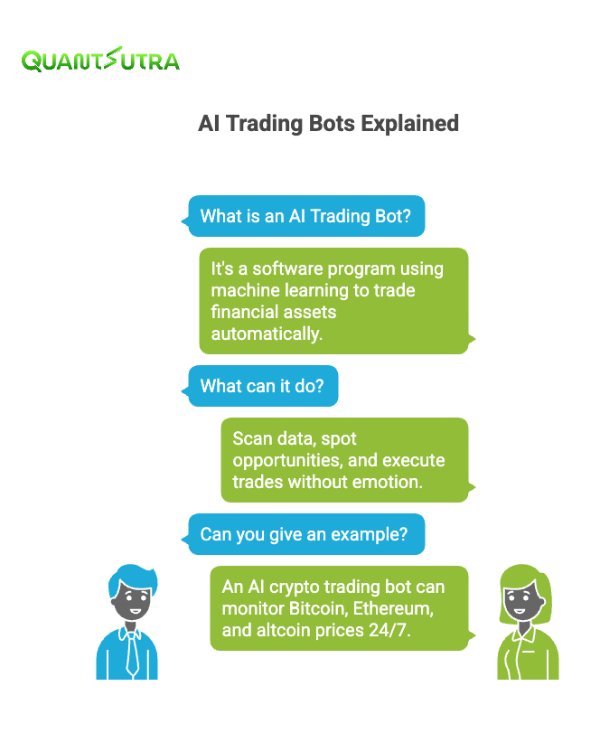

An AI trading bot is a software program that uses machine learning and algorithms to trade financial assets automatically.

These bots can:

- Scan thousands of data points in seconds.

- Spot opportunities across multiple markets.

- Execute trades with discipline, free from human emotions.

For example, an AI crypto trading bot can monitor Bitcoin, Ethereum, and altcoin prices around the clock something impossible for a human trader.

QuantSutra integrates these capabilities into its AI algo trading platform, helping traders reduce emotional bias while maintaining precision in execution.

Why AI Stock Trading is a Game Changer?

AI stock trading is not just about speed. It’s about making better decisions. Using historical data, real-time analysis, and predictive modeling, AI trading software can identify entry and exit points with higher accuracy.

Traders using an AI stock trading app don’t need to sit glued to their screens. Instead, the app automates execution, applies stop-loss strategies, and manages risk.

With QuantSutra’s AI Algo trading platform, traders can access advanced indicators, structured strategies, and automation that give them an edge in today’s competitive markets.

Also Read – Why Backtesting Matters: Build Confidence Before You Trade? Click Here!

AI vs Human Traders: Who Has the Edge?

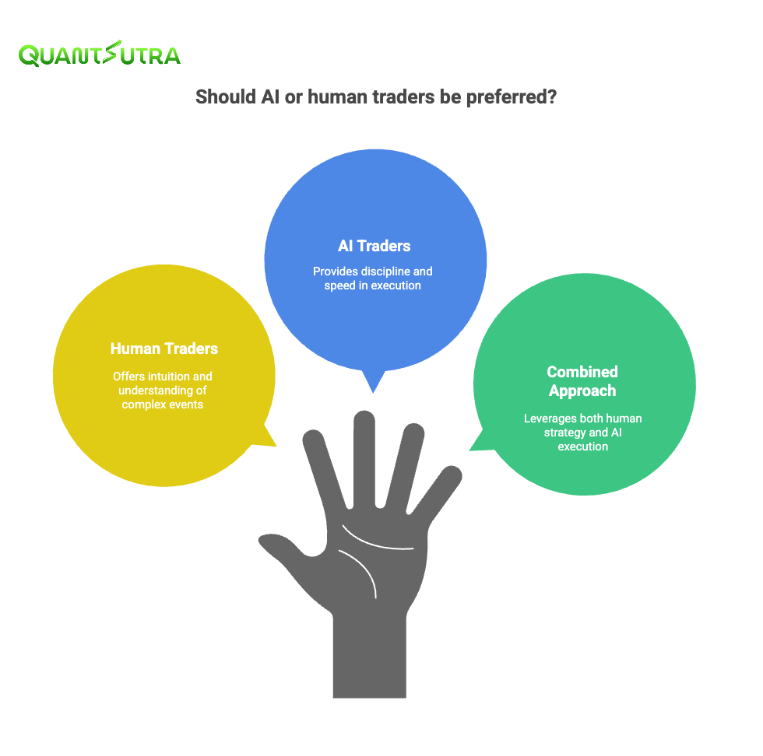

This is a question many investors ask: Can AI replace human traders?

- Humans bring intuition and creativity. They can understand macro events, political shifts, or black swan scenarios that no machine can fully grasp.

- AI bot trading brings discipline and speed. No fatigue, no emotions, no hesitation.

The real edge comes when AI and trading are combined. A human sets the strategy, and an AI trading platform executes it flawlessly.

That’s exactly the approach QuantSutra believes in combining human intelligence with machine-driven execution for consistent, long-term results.

Benefits of AI Trading Applications!

Here’s how AI for trading stocks is changing the game:

- Speed & Efficiency – Execute trades in milliseconds.

- Risk Management – Automated stop-loss and portfolio balancing.

- Emotion-Free Trading – No fear, greed, or panic selling.

- 24/7 Market Access – With AI crypto trading bots, trading never stops.

- Scalability – One trader can manage multiple assets with ease using an AI stock trading app.

QuantSutra’s AI bot trading platform give retail traders access to these exact benefits, leveling the playing field against big institutions.

Also Read – 5 Reasons Retail Traders Are Switching to Algorithmic Platforms Like QuantSutra! Click Here!

Frequently Asked Questions

It’s a software program that uses algorithms and machine learning to analyze markets and automatically place trades. Platforms like QuantSutra provide these tools for retail traders.

It can be, but profitability depends on the trading strategy, market conditions, and the quality of the AI trading software used. QuantSutra’s tools are designed to maximize efficiency while minimizing risks.

No. While AI bot trading excels in execution and speed, humans are still needed for strategy, creativity, and decision-making in unpredictable events.

It simplifies the process by automating execution, managing risks, and offering a user-friendly interface. QuantSutra’s app is built to support both beginners and professionals.

They allow traders to participate in 24/7 crypto markets by monitoring prices and executing trades automatically, even while you sleep. QuantSutra’s Algo trading platform give users access to global markets without missing opportunities.

Conclusion

Artificial Intelligence is no longer just a buzzword in finance it’s the driving force behind the next evolution of trading. From AI stock trading apps to AI crypto trading bots, these tools are transforming how markets operate.

The real winners won’t be just the machines or just the humans it will be the traders who learn to harness the power of both. By blending human insight with AI trading platforms, investors can trade smarter, faster, and more efficiently than ever before.

At QuantSutra, we believe in giving retail traders the same advanced AI-powered trading tools used by institutions. Whether you’re exploring AI bot trading, looking for an AI stock trading app, or simply want to reduce emotional bias QuantSutra helps you stay ahead in an AI-driven market.