Blog

AI vs Human Traders: Who Wins in the

Long Run?

Trading has always been a battle between logic and emotion. On one side, we have human traders who rely on intuition, market experience, and sometimes a gut feeling. On the other, we have AI trading bots,

AI stock trading software, and sophisticated AI algo trading platforms that run on algorithms and data.

The big question is: In the long run, who wins AI or human traders? Let’s break it down.

Human Traders: Strengths and Weaknesses!

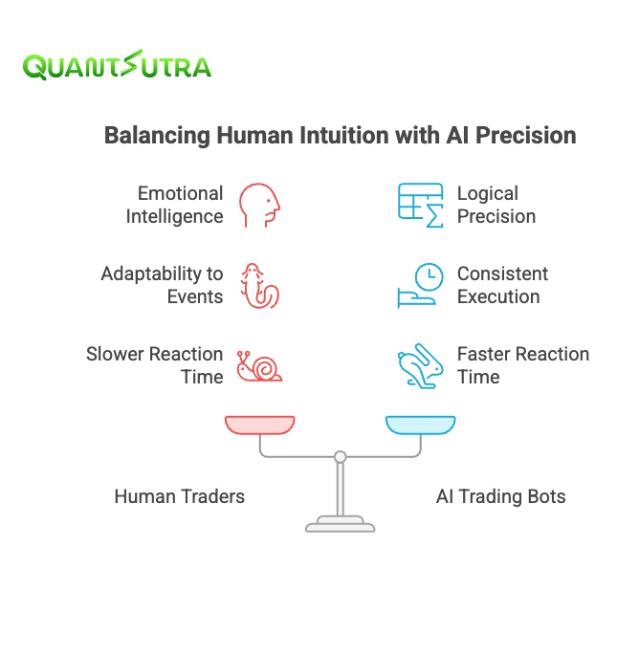

Human traders bring something to the table that no algorithm can fully replicate emotional intelligence and intuition.

They can adapt to sudden global events, interpret breaking news, and understand market psychology in ways machines sometimes miss.

But humans have limits. Fatigue, emotional biases like fear and greed, and slower reaction times often lead to costly mistakes.

For example, panic selling in a market dip is a classic human error that an AI trading bot would likely avoid.

AI Trading: How It Works?

An AI trading bot is essentially software that automates trades using real-time data, predictive models, and risk management rules. Unlike humans, it doesn’t sleep, doesn’t panic, and can analyse thousands of data points in seconds.

AI for stock trading is now common among institutions and retail traders.

Whether it’s an AI stock trading app on your phone or a high-frequency AI trading platform, the core idea is the same let algorithms make faster, data-backed decisions.

Quick Answer: An AI trading bot is a software application that uses machine learning and algorithms to automatically buy and sell assets based on data-driven strategies.

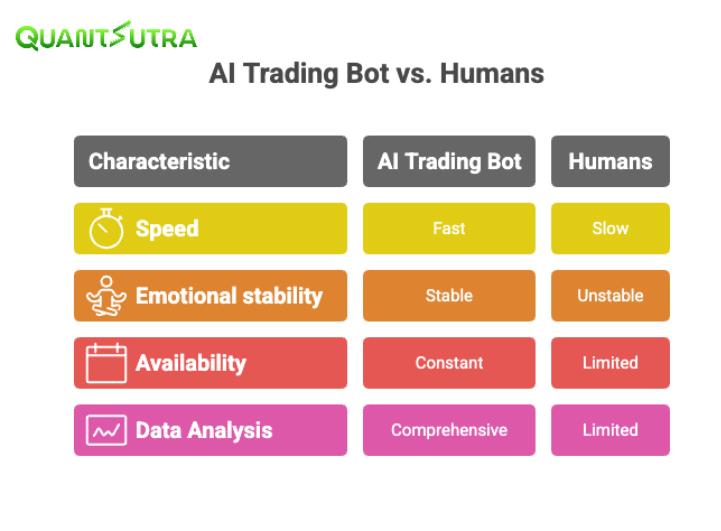

AI vs Human Traders: Head-to-Head!

So, how do they stack up?

| Factor | Human Traders | AI Trading Bots |

|---|---|---|

| Speed | Slow, limited by reaction time | Executes in milliseconds |

| Emotions | Influenced by fear, greed, overconfidence |

Emotion-free, rule-based |

| Adaptability | Can interpret news & black swan events |

Struggles with completely new situations |

| Data Processing | Limited to what one can analyze manually |

Processes huge datasets instantly |

| Consistency | Varies daily | Consistent and disciplined |

Clearly, AI stock trading platform wins in speed, accuracy, and consistency, while humans still hold an edge in intuition and creative strategy.

Also Read – Manual vs. Algorithmic Trading: Which One Wins in 2025? Click Here!

Long-Term Perspective: Who Wins?

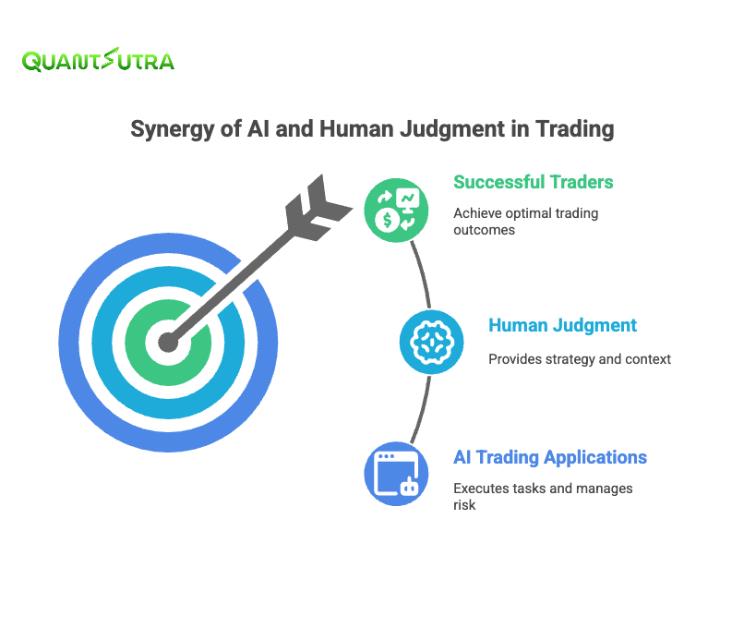

The truth is, it’s not about AI vs Humans, but AI + Humans. In the long run, the most successful traders are those who leverage AI trading applications while still applying human judgment.

Think of it this way – AI handles execution, risk management, and repetitive decisions. Humans step in for strategy, context, and big-picture thinking.

In fact, many top hedge funds already rely on AI bot trading systems, but always with human oversight. That’s likely how the future will play out for retail traders too.

The Role of AI Stock Trading Apps & Platforms

Retail traders now have access to tools that were once reserved for institutions. A modern AI stock trading app or AI trading platform can:

- Run 24/7, even in crypto markets with AI crypto trading bots.

- Automate complex strategies with minimal human effort.

- Reduce risks by removing emotional decision-making.

This democratization of trading means even small traders can compete at a higher level with the right AI trading application.

Frequently Asked Questions

An AI trading bot is software that uses algorithms and machine learning to analyze markets and automatically execute trades.

Not completely. AI excels in speed and consistency, but humans are still needed for creativity, intuition, and responding to unpredictable market events.

It can be, depending on the strategy, the AI trading software used, and risk management. Many traders use AI to improve discipline and efficiency.

By removing emotions, following strict rules, and applying real-time data analysis, AI trading bots can reduce impulsive or panic-driven decisions.

The best results often come from combining both using AI trading platforms for execution and humans for strategic thinking.

Conclusion

So, who wins in the long run AI or human traders? The answer is neither, at least not alone. The future of trading lies in collaboration. Humans bring intuition and creativity. AI trading applications bring speed, discipline, and precision. Together, they create a more efficient, balanced approach to navigating the markets. If you’re serious about trading smarter, tools like QuantSutra’s advanced indicators and algo strategies can help bridge the gap between human insight and AI trading power.